do i have to pay tax on a foreign gift

Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who. Person receives more than 100000 through a foreign inheritance or gift.

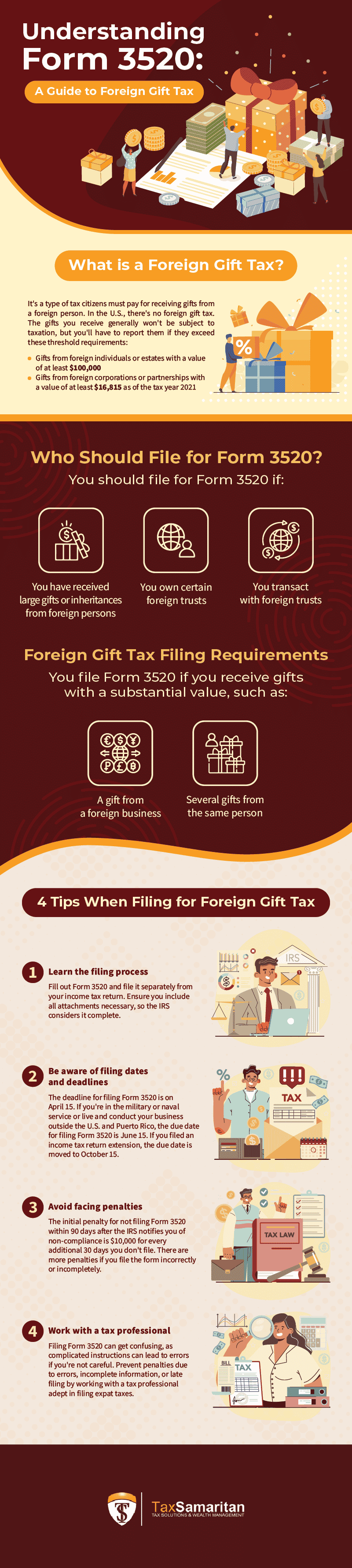

Understanding Form 3520 A Guide To Foreign Gift Tax

As the recipient of the gift you do Not report the gift on a US tax return regardless of the amount received.

. Under special arrangements the donee person receiving the gift may agree to pay the tax instead. In cases where gifts are taxable the sender is required to pay tax not the recipient. Transfers by gift of property not situated in the United States from foreign nationals.

However since the gift is from a foreign person you must report the gift received to. The fact that the gift is from a foreign person is irrelevant. Cash Gifts Up to 16000 a Year Dont Have to Be Reported.

Person receives one or more gifts from a Foreign Person individual entity or trust the recipient may have to report the value to the IRS. The short answer is that the United States does not impose inheritance taxes on bequests. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

However you may be required to furnish proof that you paid any estate or gift tax to a foreign government. This rule stands for. Cash gifts can be subject to tax rates that range from 18 to 40 depending on the size of the gift.

Gifts From Foreign Person IRS Reporting. Typically if a foreigner gifts money or property except intangibles such as. Do I Have To Pay Tax On A Foreign GiftGifts from foreign persons gifts from foreign persons.

The gift tax requires you to pay taxes on any large monetary gifts over a certain threshold. The tax applies whether or not the donor. Paying Tax on Gifts Received from Abroad.

Person who receives a gift. However because this is an information return and not a. The IRS defines a foreign gift is money or other property received by a US.

The tax is to. Person from a foreign person that the recipient treats as a gift and can exclude from gross income. The same is true for those who receive an inheritance.

If you are a US. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. When money is transferred overseas as a gift you may not have to pay taxes on it.

This form applies in cases where a US. You will not have to pay tax on this. If the donor does not pay the tax the IRS may collect it from you.

If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. Although youll pay no taxes youll file Form 3520 at tax time reporting all gifts received from overseas on that form. The burden of paying the gift tax falls on the gift-giver.

While you may not need to pay tax on large sums of money being sent abroad. The person who does the gifting will be the one who files the gift tax return if necessary and pay any tax due. You can gift up to 11180 million in your lifetime without owing this tax but youll.

If required you must report the gift on Form 3520. International Tax Gap Series.

Estate And Inheritance Taxes Around The World Tax Foundation

Gifts From Foreign Corporations Included As Gross Income

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Tax Implications When Making An International Money Transfer

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

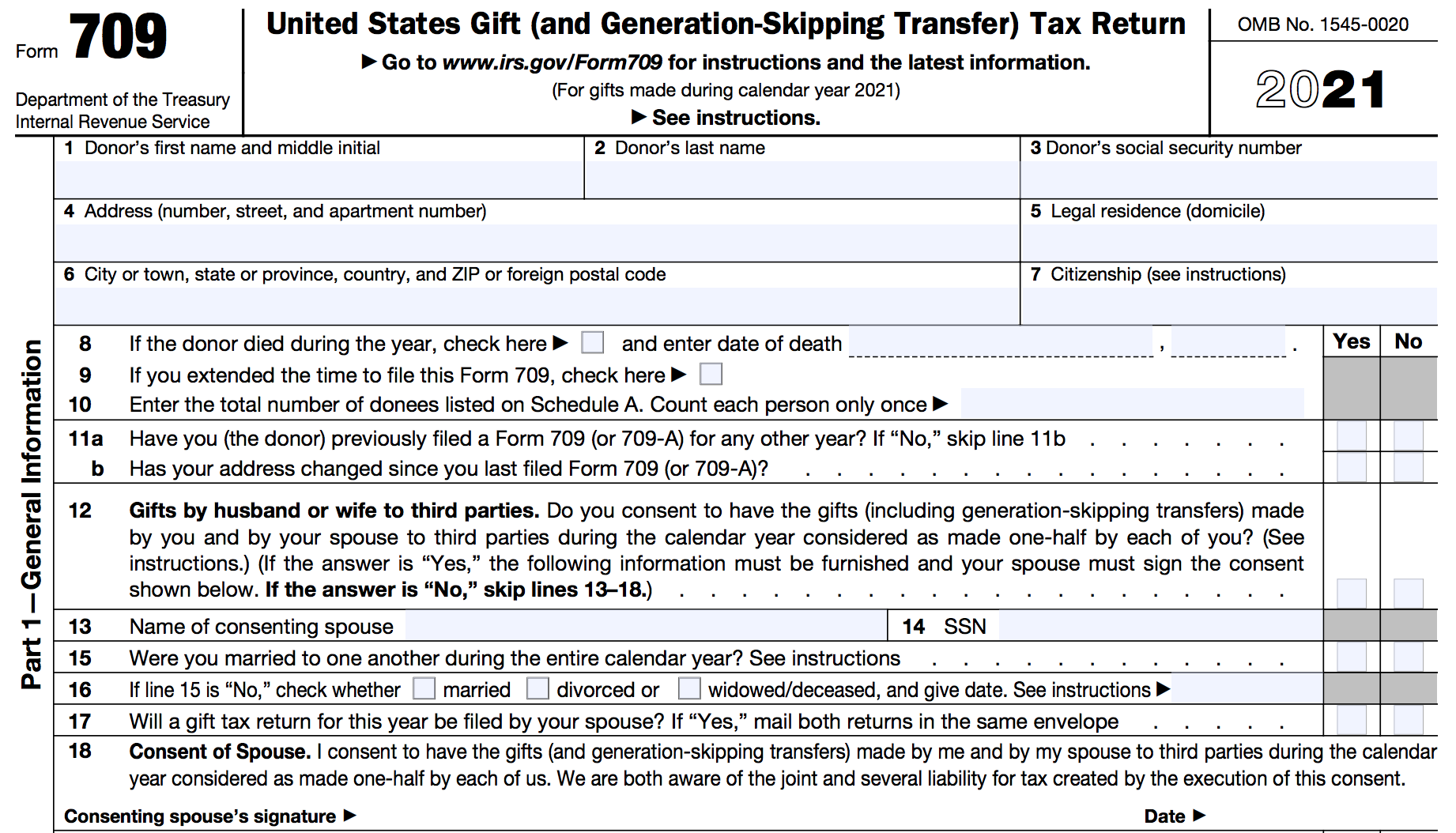

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Foreign Nationals And U S Gift Tax Consequences Of Executing Certain Real Property Deeds Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Gifts From Foreign Persons New Irs Requirements 2022

Foreign Gift Tax Do I Have To Pay Cerebral Tax Advisors

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Gifts From A Foreign Person Non Resident Alien O G Tax And Accounting

Foreign Gift Reporting Penalties Thresholds For Purposes Of Reporting A Foreign Gift Form 3520

Are There Special Tax Rules For A Gift Or Inheritance From A Foreign National

Reporting A Gift From A Foreign Source Taxcpe

The Gift Tax Made Simple Turbotax Tax Tips Videos

Form 3520 Top 6 Traps Expat Tax Professionals

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset